Today marks the return of an increased welcome bonus offer on the Marriott Bonvoy™ American Express® Card and a change to the offer on the Marriott Bonvoy™ Business American Express® Card. It has been a couple of months since we've seen a limited time offer for the consumer card so it is a welcome sight to have one again while the business card still had a limited offer in place up until today it has now changed to more closely line up with the consumer card offer.

The welcome offers are as follows:

Marriott Bonvoy™ American Express® Card- New Marriott Bonvoy® American Express®* Cardmembers, earn 65,000 Welcome Bonus points and a $100 Statement Credit after you charge $1,500 in net purchases to your Card in your first 3 months of Cardmembership. Offers end May 10, 2022.

Marriott Bonvoy™ Business American Express® Card

Marriott Bonvoy™ Business American Express® Card

- Earn 65,000 Welcome Bonus points + $100 statement credit after you charge $3,000 in net purchases to your Card in your first 3 months of Cardmembership. Apply by May 10, 2022.

Here at Rewards Canada we value Marriott Bonvoy points a 1 cent a piece (C$) which puts the welcome bonus value at $650 for either card. Add in the statement credit and subtract the annual fees and you overall value is $630 for the consumer card and $600 for the business card. Those are minimum values for the time being, at least for 2022.

As you may or may not know Marriott Bonvoy is moving to dynamic pricing later this month which means redemption rates at hotels will follow the cash price more closely. For 2022, Marriott has promised 97% of hotels will remain in their current points requirement range and 3% will be charging more. We already know the 3% of hotels that will cost more and you can find that list in the link right below this paragraph. Here in Canada only of one of our hotels, the JW Marriott Parq Vancouver is moving up in point cost this year. Key word or words in all of this is '2022' and 'this year' as for 2023 it will change and we'll most likely see that one cent per point valuation drop. My guess is that one Marriott point will be worth 0.7 to 0.8 cents (C$) although I hope to be wrong - on the low side that is!

Recommended reading: Marriott Bonvoy's dynamic pricing will go live on March 29 - some hotels will be going up in points price by 50%!

I would also highly recommend reading our reviews of the cards so that you can see the huge value and potential in them:

And while I won't cover everything in this post that these cards do offer I will go into some of the redemptions you can expect from these card's 65,000 point welcome bonuses.

Free nights at Marriott Hotels

With 65,000 points - actually at least 68,000 points on the personal card and 71,000 points on the business card since you have to spend $1,500 and $3,000 respectively to get the bonuses - you'll have multiple free night options with the Marriott Bonvoy program:

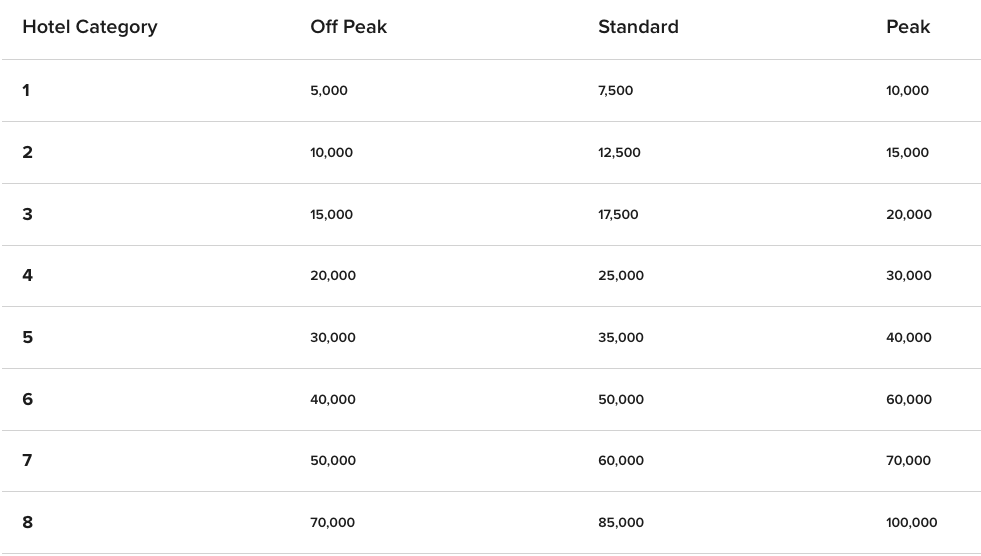

This is Marriott's standard free night chart which as you can see you'll have enough points for one standard night at a Category 7 Hotel with the consumer card or one Off Peak night at a Category 8 hotel with the business card. On the complete other you can have thirteen to fourteen nights for an Off Peak redemption at a Category 1 hotel. No matter which route you go for redemption you should be able to extract at least $600 in value from the welcome bonus points alone!

DO NOTE: You can only book stays at the above set rates until March 28 which means this chart will no longer be in use by the time you get the welcome points posting from your credit card. On March 29 Marriott moves to their dynamic pricing which for the most part will still fall into those rates posted above for the remainder of this year. You can however take advantage of Marriott Points Advance right now which is Marriott's system of letting you book award nights without having the points (you have to have them in your account no later than 14 days prior to check in) but points advance only guarantees your room not the amount of points. If the rate goes higher by the time you have enough points to cover the stay you'll have to pay more.

At least 25,000 airline miles/points

Your other great redemption option with Marriott Bonvoy is converting the points to any one of their 40+ airline partners. Points convert at a 3:1 ratio however when you convert 60,000 Marriott Bonvoy points at once Marriott will kick in the equivalent of 5,000 miles or points as well. That means the new 65,000 point welcome bonus on both of these cards is the same as getting 26,667 miles or points in most of their airline partners and this doesn't include the points from your spending either.

Card features and benefits

The value in these cards doesn't end with just the new welcome offers. The cards have some great features and benefits including being some of the highest earning cards on non-category bonus spending since both earn 2 Marriott Bonvoy points per dollar spent on everyday spending (or about a 2% return, again this may change soon) Then you have the annual free night award that easily provides $150 to $200 or more in value, automatic Silver Elite status and more:

Marriott Bonvoy™ American Express® Card

• Earn 5 points for every dollar in eligible Card purchases at participating Marriott Bonvoy™* properties

• Earn 2 points for every $1 in all other Card purchases

• Receive an Annual Free Night Award for up to 35,000 points at eligible hotels and resorts worldwide every year after your first anniversary

• No annual fee on Additional Cards

• Redeem points for free nights with no blackout dates at over 7,000 of the world’s most desired hotels

• Automatic Marriott Bonvoy Silver Elite status membership

• Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy™ American Express® Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program

• Enjoy an automatic upgrade to Marriott Bonvoy Gold Elite status when you reach $30,000 in purchases on the Card each year

Apply for the Marriott Bonvoy™ American Express® Card here

---

Marriott Bonvoy™ Business American Express® Card

• Receive an Annual Free Night Award automatically each year after your anniversary

• Enjoy an automatic upgrade to Marriott Bonvoy Gold Elite status when you reach $30,000 in purchases on your Card each year

• Receive 15 Elite Night Credits each calendar year with your Marriott Bonvoy Business American Express Card. These can be used towards attaining the next level of Elite status in the Marriott Bonvoy program

• You can earn 3 points for every $1 in Card purchases on eligible gas, dining and travel

• Earn 5 points for every $1 in Card purchases at participating Marriott Bonvoy properties. Earn 2 points for every $1 in purchases charged to the Card everywhere else

• Make the most of a suite of business management tools that give you more control over your business anytime and anywhere

Apply for the Marriott Bonvoy™ Business American Express® Card

---

Who should get these cards:

- Marriott Bonvoy point collectors - the fact that you can have one or both of these cards in your wallet at the same time will make sure your Bonvoy points earning is supercharged

- People who are interesting in pulling the maximum value out of each dollar they spend on their credit card

- Members of one of Marriott Bonvoy's partner airlines that have no other method of collecting points or miles in that airline program

- People who want to stay at luxurious hotels and resorts but typically cannot afford paying the cash rates for those hotels

Wrapping it up

It may not total to 105,000 points like the offers we saw in summer of 2021 for these cards but it is nice to see a new increased welcome bonus for the consumer card which has now been sitting with its standard 50K bonus for the better part of two months. To get 65,000 Bonvoy points and a $100 statement credit after only three months (or less) is pretty sweet. What will be telling is the shift in points requirements coming at the end of March - will there still be some good deals to be had? I think there will be, not at those 200 hotels going up in price but pretty much everywhere else. What about 2023? I wish I had a crystal ball to see what will happen next year and even though the per point value will likely drop in 2023 I do feel there will still be value in the program and thus in these cards. And I say this as someone who has the consumer card and is still using it heavily for non bonus category spending.

Click here to see these and all other Amex offers on our Amex page.

*American Express is not responsible for maintaining of monitoring the accuracy of information on this website. For full details and current product information click the Apply now link. Conditions apply.